Case studies that show how we build operational leverage.

These projects highlight our software and automation expertise—why small business owners trust us to also run monthly bookkeeping and tax workflows with process and precision.

Featured case studies

A sample of delivery across DevOps, analytics, security, and automation.

DevOps CI/CD Implementation

Deployment time ↓ 70%Streamlined releases and reduced manual steps with a modern CI/CD workflow and repeatable deployment patterns.

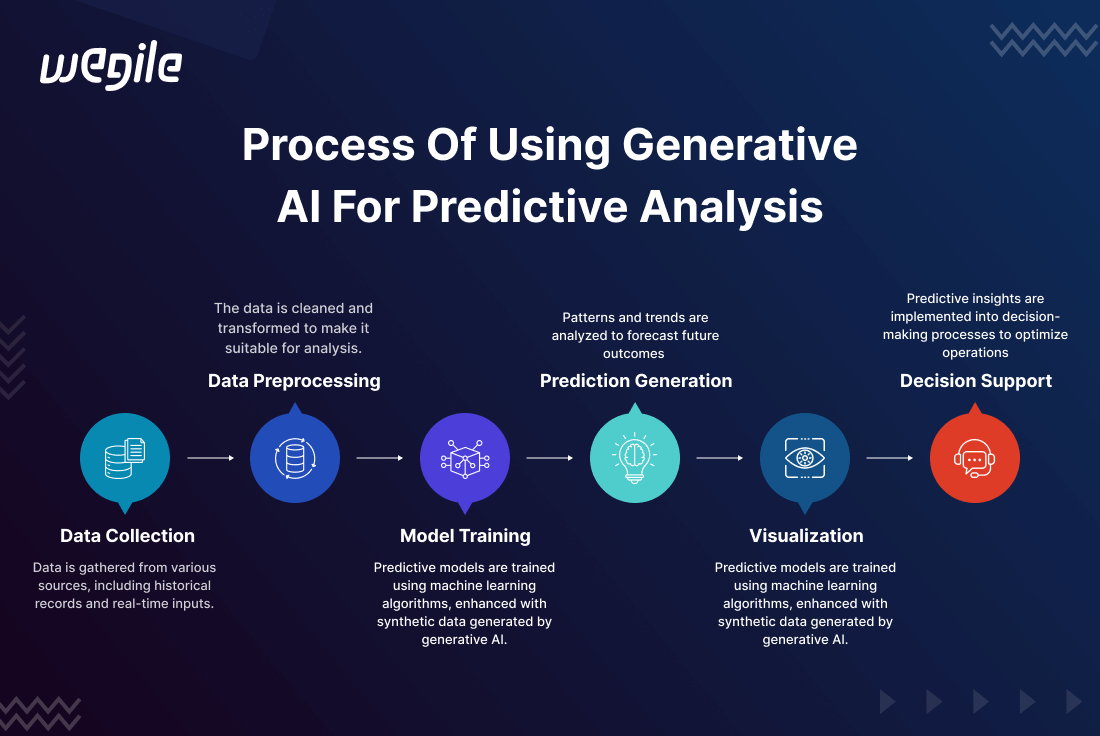

GenAI Predictive Analytics

Revenue lift +25%Built forecasting workflows and dashboards that made trend signals actionable for operators and leadership.

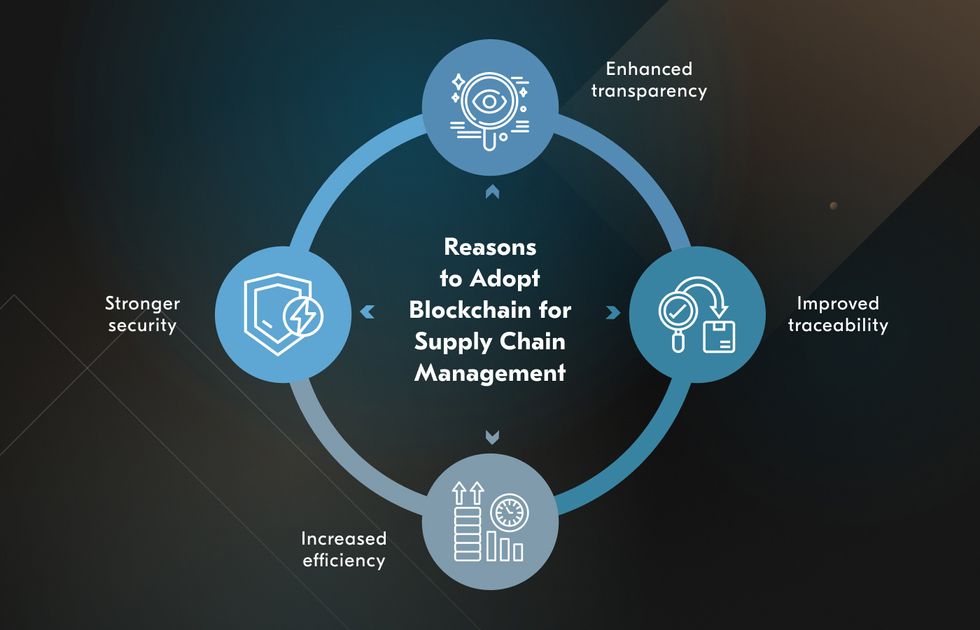

Supply Chain Visibility System

Fraud ↓ 40%Implemented transparent tracking and audit trails to improve verification and reduce disputes across partners.

Cyber Security Audit

500+ endpoints securedPerformed audit, hardening, and monitoring improvements to reduce risk and improve response readiness.

Data Engineering Pipeline

1TB/day processedBuilt a scalable pipeline with monitoring and retries to keep downstream reporting reliable and consistent.

RPA Finance Automation

80% workflows automatedAutomated repetitive finance tasks with consistent logging and exception handling to reduce operational drag.

Why this matters for taxes + bookkeeping

The same systems mindset used in these projects is how we run bookkeeping and tax workflows: consistent inputs, clean categorization, predictable closes, and reporting you can trust.

Let’s build something that saves time every month.

Whether you need ops automation, clean books, or tax help—start with a free consult.